The Only Guide for Redbud Advisors, Llc

Table of ContentsEverything about Redbud Advisors, LlcThings about Redbud Advisors, LlcRedbud Advisors, Llc Can Be Fun For AnyoneNot known Facts About Redbud Advisors, LlcThe Redbud Advisors, Llc DiariesThe 9-Minute Rule for Redbud Advisors, LlcIndicators on Redbud Advisors, Llc You Need To KnowOur Redbud Advisors, Llc DiariesAll about Redbud Advisors, Llc

Accounting professionals who succeed at routine might not have strong social skills: they're grinders. Accounting professionals that have individuals abilities need to be positioned in a position that makes use of their toughness: speaking and handling customers. By tailoring each hire to the ideal function, you can focus on the highest initiative and wage on one of the most important duty for solid growth: finder and minders.Finders should have the strongest interaction skills in accountancy due to the fact that they connect with customers. http://go.bubbl.us/de3197/6f26?/New-Mind-Map. They should speak plainly, and line up with the goal of the firm. Minders are trusted, seasoned accountants with the knowledge, yet not necessarily individuals abilities. They can be coupled with a competent finder in a client meeting, to assist clarify more technological information.

The Single Strategy To Use For Redbud Advisors, Llc

They're all set and eager to place in the time and initiative to obtain the work done. Three points to look for in grinders: Attitude: You can teach people skills, however you can not educate them the ideal mindset.

In addition, company owners need to develop organization entities that create most favorable tax obligation situations. Cannabis business advisors OKC. Accounting firms aid recognize the ideal remedies which aid in the production of entities that make the ideal tax sense for the firm. Some estate preparation requirements are unique to several company proprietors, and an accounting firm assists determine these

The Definitive Guide to Redbud Advisors, Llc

Firms will collaborate with estate planning lawyers, financial coordinators and insurance coverage representatives to execute long-lasting methods for business transfers and to mitigate inheritance tax. Numerous entrepreneur are great at providing the product or service that is the backbone of the company. Yet company owners aren't constantly professionals at the financial facets of running a business.

Some Of Redbud Advisors, Llc

They rush to launch their business development campaigns to generate even more leads and close sales. They then realized that the company had no new consumers and advertising and marketing.

The Facts About Redbud Advisors, Llc Revealed

Receive info concerning the benefits of our programs, the courses you'll take, and what you need to apply.

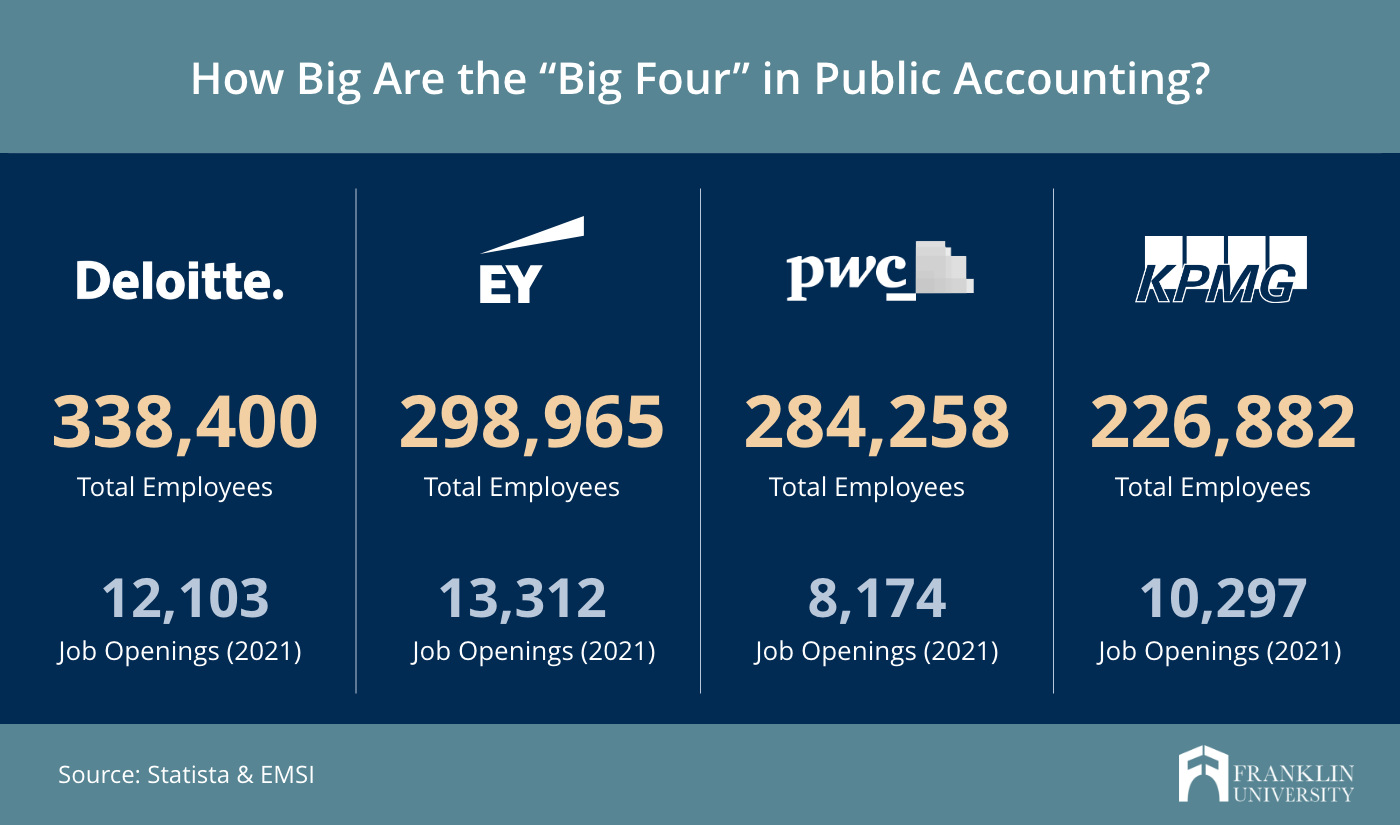

Beginning an audit company is like beginning any type of small company it calls for a whole lot of job. Industry and consulting companies list accountancy firms as one of the single most successful tiny businesses a person can begin right currently.

The 10-Minute Rule for Redbud Advisors, Llc

Beginning an audit company is no different from starting any other tiny service. And while there are accounting-specific demands, it's crucial to remember that you're beginning a business.

9 Simple Techniques For Redbud Advisors, Llc

Nonetheless, if you are seeking to concentrate on the plethora of various other services accounting firms offer, it's likely not a required credential to begin. And while there are particular state-by-state exemptions concerning what can and can not be embarked on by a CERTIFIED PUBLIC ACCOUNTANT, they are not a requirement for beginning an audit firm.

Among the advantages of starting an accountancy firm is flexibility. So, the straightforward solution to the question is, yesmany accounting professionals can and do work from an office. All the regulations that apply to a physical area likewise relate to digital or office. Not having a physical office does not place an audit company at a negative aspect.

Some Known Factual Statements About Redbud Advisors, Llc

These consist of: Shared job locations. https://josephs-dandy-site-cfb549.webflow.io/. There are many co-working areas across the nation, a lot of which include both room for professionals to do their jobs, in addition to giving a professional, on-demand area to consult with clients. While there is typically a regular monthly cost to make use of these areas, the benefits they provide are often worth the expense (and are significantly more affordable than renting or purchasing workplace room)

Make sure you explore and conform with any legislations to ensure your home-based organization isn't running illegally. While not having a physical area can be testing at times, it can additionally be an advantage. Consider visiting customers onsite.

The Basic Principles Of Redbud Advisors, Llc

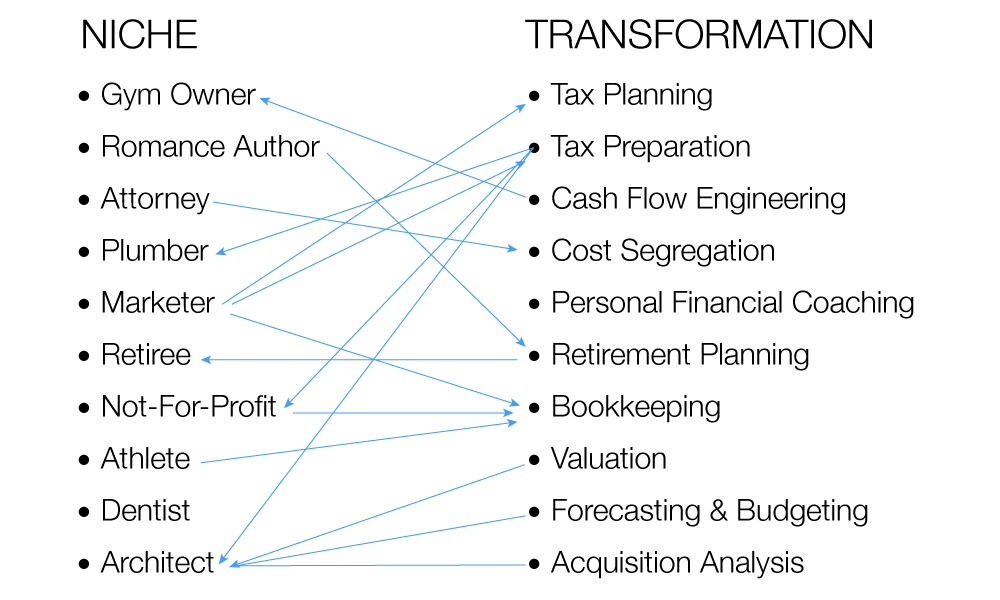

In several ways, this inquiry can be answered by as soon as again checking out your goals and target market. What are the key solutions needed by that populace? Just how can you offer them far better? Still, while many services will be determined by the specifics of your clients and their organization, there are a few requirements most accounting firms use, including: Tax Audit Assurance solutions Bookkeeping Payroll While these are typically the core offerings and the ones that will provide constant company in a lot of accountancy firms it's likewise crucial to investigate emerging and buzz-worthy solutions that are attracting bigger and a lot more progressive accountancy businesses.

:max_bytes(150000):strip_icc()/Accounting-FINAL-e01e0f2d93264a989c19357a99d7bffd.jpg)